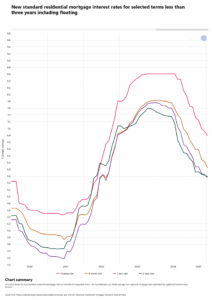

Are we are likely to see interest rate drops again as early as the August OCR announcement?

Most sectors of the New Zealand economy are pretty flat, with farming probably being the one exception. A bad economy does nothing to help with jobs and it certainly doesn’t mean certainly restricts the tax take that the government gets. Everybody needs a strong economy and ours really needs a kickstart.

This has seen a lot of business people calling for further interest rate drops.

In light of current economic conditions, many are optimistic about potential interest rate drops.

Last month the Reserve Bank decided against any cut in the OCR, citing a risk that inflation might increase above the 3.00% top end of their band. It was predicted to be 2.90%, but when the numbers came out, it was lower at 2.70%, which is deemed quite acceptable.

Digging further into the inflation figures, most of that inflation has been driven from offshore costs rather than domestic. That should give a level of comfort for most economists, knowing that the New Zealand inflation is as under control as it can be.

So that leaves the door open for the Reserve Bank to drop interest rates in August.

Interest Rate Cuts Now Expected in August

The question is how much could these interest rate drops be?

So bank economists have come out and said they will expect it to drop by 0.25%, which is fine. But then we heard John Key come out and say he thinks the Reserve Bank should be bold and drop up by 1.00%, and that’s been supported by others as well.

Of course, 0.25% will make a difference to many businesses and households that have a mortgage.

It indicates that at least interest rates are not going to go up, which gives a little bit more certainty for anybody to go and borrow money to invest in business.

But it’s certainly not bold. If the Reserve Bank came out and had a 1.00% drop, that would certainly make a huge difference to a lot of businesses and a lot of households in the country, and it could be just what’s needed to start the economy.

Will the Reserve Bank be bold?

History tells us they probably won’t be.

The Reserve Bank has a role to do and it’s not focused on driving economic growth. Generally speaking, the Reserve Bank will make incremental changes to try to keep the monetary system in New Zealand stable and that does not really support giving large interest rate drops even when so many Kiwis think that they would be justified.

We need to consider that bold moves always come with an element of risk, and the Reserve Bank tries to avoid risk where possible.

They have been criticised a lot recently for the way that they have managed interest rates, and I’m sure that they do not want anything more that could damage their reputation.

Should We Refix Now Or Wait?

So what should you do with your mortgage?

We would love to see a huge drop in interest rates. That could easily be a windfall gain for families that have mortgages, especially the larger ones, but the likelihood of that happening is not great.

There is a reasonably high possibility that interest rates will drop in August, and therefore if you have a loan that’s due to be refixed in the next few weeks, you might want to hold off and take advantage of potentially a lower interest rate.

But we do suggest that you revert to a proper mortgage strategy and don’t try to wait for more interest rate drops or chase lower rates all of the time.

We hope that you have found the information from Kiwi Edition useful. This is written by Stuart Wills and should be used in conjunction with formal financial advice.