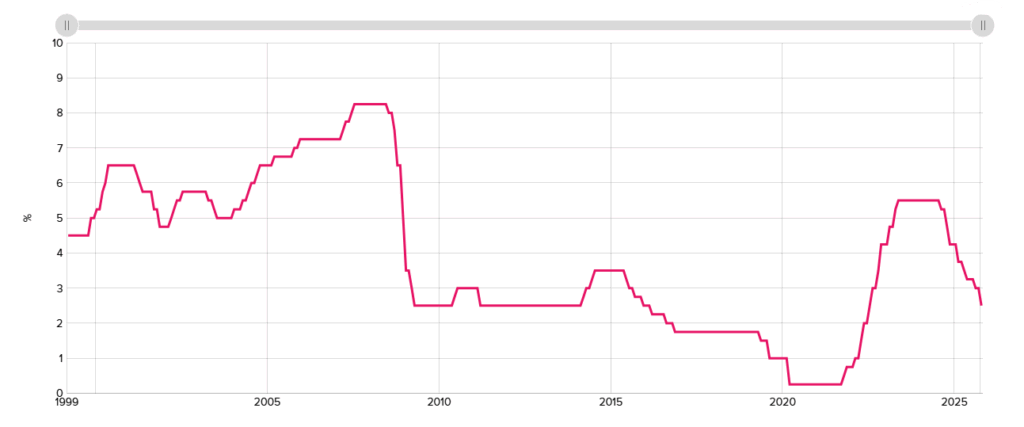

This year there has been much talk about interest rates and the cut’s that have seen the OCR drop from 5.50% in July 2024, 4.25% in November 2024 and then to 2.50% right now. With another predicted 0.25% cut on November 26th that might see the year end with the OCR at 2.25%.

Source: Reserve Bank Website

We’ve seen the OCR increase since COVID and then retreat back to a level that is seeing the longer term 5-year home loan rates drop to around 4.99% – 5.49% and the shorter 1-year and 2-year rates sitting at about 4.49%.

There are a few “special” rates that float around too – like the SBS Bank doing 3.99%.

What’s Expected on 26th November?

We are starting to see some ‘green shoots’ within the economy, but those are not across all sectors and there are still some areas of the economy that are really struggling to get back up and running.

The construction and infrastructure sectors have been really struggling and that includes the lack of major projects in progress and of course the lack of new housing being built. The good news is there are some projects in the pipeline and they should start in 2026 and we have also seen an increase in building consents to hopefully that building will start in 2026 too. These sectors are large employers too and so there is some hope that more jobs will appear and then the flow on effect might help the general economy too.

The other good news is inflation appears to be controlled now. Of course we are still going to have to deal with offshore influences and whatever Trump decides to do, but at least things seem to be more stable and that allows the Reserve Bank to focus on using the OCR as intended BUT if the economy picks up then it also means that we might not see any more interest rate cuts and we could even start to see the OCR increase again in 2026.

But for now most people are still expecting a cut of 0.25% on November 26th.

Should I Refix on Short or Long-Term Rates?

As mortgage advisers we are getting asked how long to refix for, and while we cannot predict the future we can apply some logic to the decision making process.

Firstly you need to have a conversation with your mortgage adviser around what strategy suits you and your own personal financial situation, and then you need to consider what risk you are prepared to take.

Think of fixed rates like an insurance policy – the longer that you fix your rates for the better protected you are from future interest rate increases.

But also you need to make sure that you retain some flexibility to pay more off your mortgage but not get locked into a shorter loan term and therefore potentially repayments that could be too high in the future.

You need to make sure that you really understand your home loan and switch to a better home loan too.