Meta Platforms (NASDAQ: META) is selling $30 billion in bonds on Thursday, the year’s largest high-grade corporate bond offering. The sale drew record-breaking demand, attracting $125 billion in orders.

The massive demand for the deal surpasses the previous record established in 2018 when CVS Health Corp. sold $40 billion of bonds to help fund its Aetna Inc. acquisition.

How many companies would attract this much demand?

Of course it’s hard to fully comprehend the size of Meta as a company.

Meta Platforms, Inc., doing business as Meta, is an American multinational technology company headquartered in Menlo Park, California.

Meta owns and operates several prominent social media platforms and communication services, including Facebook, Instagram, WhatsApp, Messenger and Threads. The company also operates an advertising network for its own sites and third parties; as of 2023, advertising accounted for 97.8 percent of its total revenue.

Meta is considered part of the Big Tech group, alongside Alphabet, Amazon, Apple, Nvidia and Microsoft.

It’s not an old company, originally established in 2004 as TheFacebook, Inc. It then rebranded as Meta Platforms, Inc. to reflect a strategic shift toward developing the metaverse which is likened to an interconnected digital ecosystem spanning virtual and augmented reality technologies.

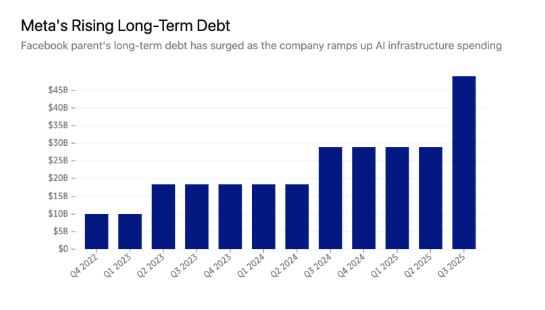

But it wanted to raise extra capital, and that saw the debt increasing.

The company has grown the debt a huge amount over the last few years!

What’s the money for?

CEO Mark Zuckerberg has indicated that Meta plans to significantly increase its investments in artificial intelligence (AI) over the coming year. Morgan Stanley projects that major tech companies, known as hyperscalers, will invest around $3 trillion in infrastructure, such as data centres, by the end of 2028, with about half of this financed through company cash flows.

Meta are very focused on the AI but some investors have concerns about this, and this latest capital raise saw a hit to the share price.

Here at Kiwi Edition we try and bring you the latest and most relevant financial news